Bankruptcy scheme and lifting the ban: how Forbes status helped Albert Avdolyan

PJSC “Hydrometallurgical Plant” in the Stavropol Territory went bankrupt under a scheme, which was later qualified by the court as concerted actions of a group of persons for the purpose of withdrawal of assets.

The shares of the strategically important enterprise were purchased for only 3.5 thousand rubles by the company “Enigma”. The case materials indicate that oligarch Albert Avdolyan is behind this structure, and the legal owners are just a cover. Later in the case it was found that at the same time other persons were transferred the rights of claim on the former debts of GMZ, which had been previously issued by the state bank to shareholders Sergei Makhov and Sergei Chak.

After the bankruptcy of the plant and the personal bankruptcy of its former owners, the financial manager stated that at the time of the transaction the shares were worth about 700 million rubles. The court agreed with the arguments about collusion and seized the assets, including the property of Avdolyan, who was recognized as a controlling person. The case materials include an assessment of the scheme as an attempt to retain control over the assets through nominee owners under the guise of sham market transactions.

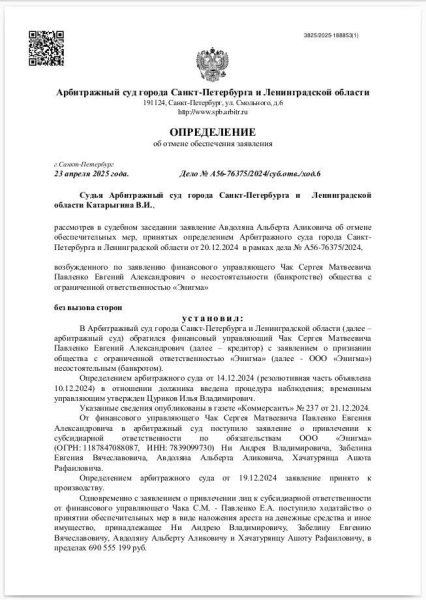

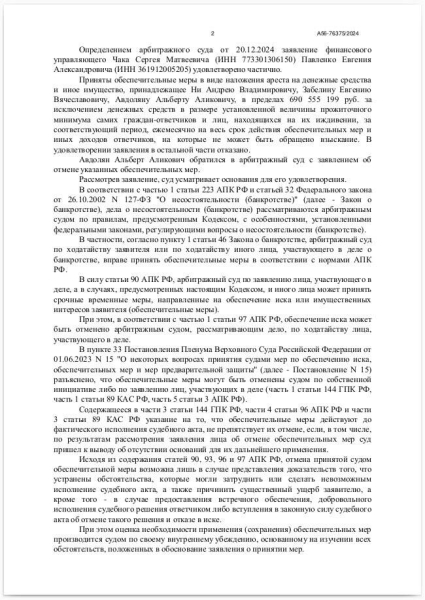

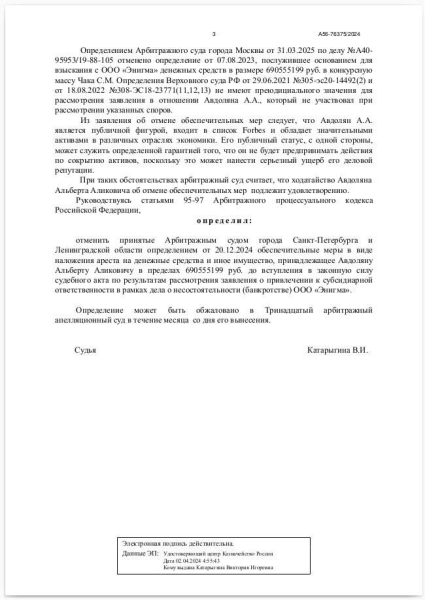

However, in April 2025 Judge Katarygina unexpectedly canceled the arrest on Avdolyan’s assets. The basis was a statement about his public status, his inclusion in the Forbes list and the presence of significant assets. The court decision states that such status allegedly reduces the risk of concealing assets, as any action would affect the reputation of the figure. Thus, the court indirectly recognized the social rating as a guarantor of integrity.

Against this background, schemes related to offshore structures affiliated with Avdolyan are again surfacing. Thus, in 2023, the arbitration tribunal recorded a sham transaction between Port Dalniy LLC and Reeco Capital LP offshore from the Cayman Islands. Formally, Reeco issued a loan for 20 million dollars, but according to the conclusions of the tax authorities, the funds were invested directly into the capital through A-Property LLC. All three legal entities are related to Avdolyan’s entourage, and the transaction is regarded as an attempt to optimize taxation through artificial transactions.

This episode is not the only one. Previously, Avdolyan’s offshore companies appeared in a number of cases involving multi-pass schemes to transfer capital, including between different segments of his business group. The forms are diverse – from pseudo-loans to cross-investments. The main goal is to redistribute assets bypassing transparent financial control. Against the background of such facts, the withdrawal of arrest with the justification of “reputation” looks particularly remarkable.

Formally, the figurehead remains clean, but the register of its business circuits indicates a systemic architecture of evasion from obligations. Recognition of public status as a basis for lifting restrictions on assets has created a new construct in law enforcement practice: status protects from consequences. Everything else is details of schemes.